Over three years ago I began writing a seemingly invaluable introduction to Bitcoin. This was on the cusp of the first mainstream crypto breakout, that made many millionaires and accelerated the impetus of blockchain’s promise to improve many of society’s ills.

My writing challenge was that cryptocurrency and blockchain are not simple concepts. Every time I tried to condense facts, figures and suggestions into bite-sized blog pieces, they transformed into marathon, over-elaborate and complicated essays. At the time, I continually plummeted more deeply into the rabbit hole of blockchain itself.

Flash forward to the present, and Bitcoin and cryptocurrency have not just stuck around: they’ve thrived and begun to mature. Numerous governments have accepted and adopted them as legal currencies, and many present-day government solutions are running successfully on blockchains. Countless top financial institutions and investment groups have poured billions of dollars into Bitcoin. The gist: Bitcoin and crypto are legit and becoming part of everyday life.

Now I have 3+ years of experience, including lessons from earlier mistakes (like temporarily recommending crypto incentive-based Steemit) and a wealth of intuition. I’ve advised numerous friends, several of whom have made a fortune. In bits and pieces, despite my humble nomadic income, I’ve picked my spots to buy my own pieces in fractional, tiny amounts. But – it adds up.

My mission is to keep this introductory article short, and to provide a preliminary homework assignment for you to embark upon. In the weeks to come we’ll branch further into details and more advanced concepts.

At the end of the day, it’s all up to you – it’s your money, future and freedom. All that’s here is my opinion and perspective from what I’ve learned. Do your best to research and question everything, and practice before you commit too much. Good luck!

An Introduction to Bitcoin – Why Blockchain is Changing the World

The notion of decentralised systems is a direct affront to the present day control by third party intermediaries over every element of our lives. Blockchain’s inherent abilities will disrupt and replace corrupted social systems as we know them. This includes the manipulated banking and economic systems, governance, healthcare, insurance, gambling, copyright and more.

Instead of trusting shady and/or faceless third parties to control our money and data, decentralised systems are run off advanced mathematics – specifically, cryptography. When the rules of blockchains are programmed, they are locked and generally set in stone. Hence, by seeing the code, you can review the rules as they are hard-programmed, and then agree/consent to proceed, or not.

Many blockchains have nothing to do with cryptocurrency. These hard-coded rules are often referred to as Smart Contracts. As immutable agreements they inherently have the potential to replace expensive lawyers or pointless insurance – as laws and terms can be programmed into purchases and agreements. For instance, buying/selling a piece of land or a car, all the rules of the transaction can be coded into a smart contract, with a safety guarantee built in to the agreement.

Envision ride sharing apps without Uber, that directly, safely liaise drivers and passengers. Or accommodation rental suiting owners and renters, without Airbnb’s ridiculous fees. By cutting out the middlemen it removes a layer of manipulation and corruption, while providing maximal value for both buyers and sellers.

Imagine everybody receiving a blockchain vote in a city or country election, or about local issues – without the need for politicians in the middle. This is all the future we’re on the cusp of with blockchain and similar technologies.

How People Make Fortunes off Cryptocurrency

This topic reaches well beyond a basic introduction to Bitcoin or cryptocurrency. Back in the day – and still prevalent with new undertakings – projects raised cash and awareness from ICO – Initial Coin Offerings. Here, blockchain-regulated shares (or tokens) were offered at minimal amounts to help raise necessary development funds. Tokens were not necessarily a cryptocurrency, but more like a digital share – and could usually be traded for common crypto coins.

Many projects were priced as low as 1 Satoshi (0.00000001 of a Bitcoin), and then with hype (and many instances of suspicious manipulation), usually just after launch, prices could temporarily skyrocket dozens or hundreds of times. Similar jumps were prevalent when more established projects were vetted upon inclusion by major exchanges, creating more potential traders. Prices spike – and astute holders who bought minimally low sold very high.

The keys to making huge returns off minimal investments were simple:

- Source promising projects run by reputable, experienced teams

- Stock up on low-cost tokens during ICOs

- Sell quickly when prices spiked up at launch

- Stock up more tokens before a coin was added to an exchange (basically by continually following the project’s news)

- Sell quickly when the token becomes listed on the exchange

There were real hazy legal questions about ICOs, in a time before mainstream acceptance and any regulation. Furthermore, most ICOs were shitty projects and worthless coins. People bought into them hoping for prices to skyrocket, then they’d plummet down to Earth and become less than worthless. Meanwhile, project founders and early supporters often became instantly rich.

In more recent times, the traditional ICO has transitioned to the more accepted STO (Security Trading Offering), more for legal compliance. There are many other ways and ICO alternatives of buying into new projects.

Following this preliminary introduction to Bitcoin, we’ll look deeper into how to better evaluate quality coins and projects.

Cryptocurrency Security and Safety

In subsequent weeks we’ll address classic cryptocurrency wallets, including keys, hardware wallets and so forth. Each week we’ll integrate safety and best practice information with the latest topic.

For today’s introduction to Bitcoin, understand a few basic terms:

Two Factor Authentication – TFA should be a mainstay on any important site, financial service or platform you use on the Internet. I wouldn’t trust a bank or crypto platform without it. Usually you have the choice of a temporary SMS code, but I prefer using an app like SAASPASS (iOS) or Google Authenticator. Like anything, make sure you note down the emergency keys. If your computer or account ever get hacked, Two Factor Authentication will save the day, and potentially all your funds. Nobody can get in and do anything significant without passing 2FA.

A private key is a sophisticated form of cryptography that allows a user to access his or her cryptocurrency. A private key is an integral aspect of bitcoin and altcoins, and its security make up helps to protect a user from theft and unauthorized access to funds. (From Investopedia)

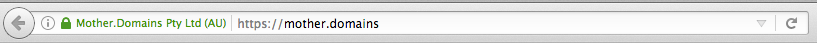

SSL-enabled websites – This is a little padlock, often green, visible in your browser’s URL beside web addresses. Suffice it to say, never logon to any important site without this padlock – particularly those of financial or private-related information. Before you logon to any site, check the padlock – if it’s not there, or there’s a warning, HALT. It might not be the legitimate domain, it might be hacked, or there might be a temporary security leak.

Here is some further terminology related to Bitcoin and cryptocurrency.

This Week’s Homework: Enroll on Trusted Platforms

For this ongoing series I’ll be referring to several major platforms and services. If you have the same apps it will be easier to follow along and understand, while also receiving the same benefits that made me sign up to these places in the first place!

Note that KYC – Know Your Customer – is now a common requirement of most legit exchanges, services and platforms. It’s a pain, but it has to be done. It’s too much hassle to try to make things work on less reputable services without this – and then everything is traceable anyway. I’ll share tips on anonymity and privacy in future articles – but you still need a safe means of getting money into and out of crypto.

Binance – We’ll use this for the more power analysis of charts and better-priced purchases than any of the exchange platforms or services. They have access to vastly more coins than just about anyone, at the fairest / most accurate prices, and the charts/graphs are intricate. Sign up for Binance here…

Crypto.Com – Sign up, add some infinitely rising CRO and we both earn $50! This is an authentic crypto VISA card, that pays cashback for purchases. I’ve been following them 3+ years and invested in their ICO when they were Monaco (MCO). Years of progress later they received VISA’s blessing and support. This is presently my favourite crypto app, that is compellingly easy to top up purchases with a bank/credit card, with a rapid, concise overview of account balances. $50 bonus here… – use code duq6omcaet

BitPanda – A legitimate exchange I still maintain as a backup (e.g. if other services temporarily fail, or block cards/accounts, etc). Like everything related to computers: Have a backup. Bitpanda offers a clean, easy interface, and lots of options. Earn €10 from signing up! Sign up for BitPanda here…

Make your first trade – After you’ve successful enrolled, using any of the above platforms you feel most comfortable with, try acquiring a tiny fraction of Bitcoin. For instance, $10-100. You’ll feel the bewilderment of money disappearing into nowhere, until the blockchain calculates your order and drops it in your account. This is a very low risk way to understand the process and get a feel for some of its unique mannerisms.

Bonus – Final assignment – For purpose of learning, try setting yourself up with a classic crypto wallet. This will be another backup for you, but you’ll also better understand the security fundamentals of cryptocurrency wallets and how you could potentially lose everything if careless. No KYC required. My recommended wallet: Blockchain.com. Don’t worry if this is too confusing for now – we’ll revisit wallets at a later time.

Wrapping up the Introduction to Bitcoin

I tried, but this wasn’t short at all. Hopefully, it was simple and concise enough. If you’re happy with this introduction to Bitcoin, and/or make a fortune from my advice, don’t hesitate to practice sending any cryptocurrency of your choice with any nominal donation. Email me on sea at gashe dot com!

Coming soon – How to monitor various coins and projects? What prices are worth buying at? How to spot and invest in solid coins and projects? What is The Bounce? Top Bitcoin alternatives? Cryptocurrency soft/hard wallets and safety practices? Revolutionary projects close to fruition? All these and more to come, on DigitalNomad.Blog.

Trackbacks/Pingbacks